| About Us | What We Do | Clients & Investors |

We provide quantitative pricing and underwriting services to clients that need accurate modeling of prospective assets or holdings for the purpose of bidding or acquisition. The solutions are based upon precise financial engineering models derived from financial and economic principles, coupled with cutting-edge statistical and systematic methods, which guide the clients with their critical decision-making such as bidding for prospective asset acquisition and portfolio holdings.

Our investment strategies group provides in-house analysis based on advanced financial and statistical models and product-quality deployment solutions. We also build such models and tools with our clients through close collaboration. Our goal is to provide valuable market insights and predictive powers that fit best the clients' needs, which involve but not limited to optimal Bayesian decision-making and actionable, trading and portfolio optimization strategies that seek to gain from market inefficiencies, and forecast of macro factors that potentially drive business cycles and cross-sectional variations. Meanwhile, we also seek to maintain an active footprint with the academia community in the broad finance field.

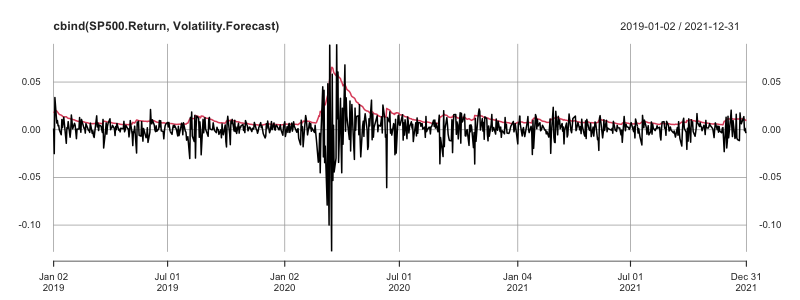

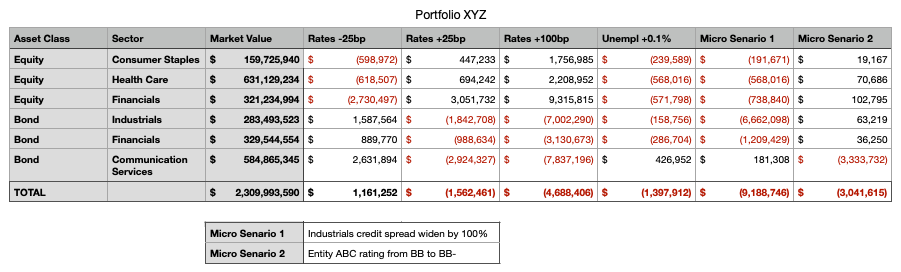

Leveraging our expertise in both pricing models (known as the Q world) and predictive modeling (known as the P world), and for different asset classes including stocks and bonds with their derivatives such as swaps and options, we work with our clients to build risk management systems and tools that produce deep insights for their businesses, reacting to both macro and micro level risk factors, such as yield curve movements, unemployment, and credit shocks to an entity or sector.

Copyright © 2026 Hudson Investing LLC. All rights reserved.